Chat with chatbot Anna. Can't figure it out? Then an employee takes over the conversation.

Opening a pension account

Save or invest for a comfortable retirement

One product: flexible saving and investing

Did you know that on average, Dutch people put aside €50,000 to top up their pension? That may sound like a lot, but the earlier you start, the longer you benefit from interest or returns, and the faster your money grows. This means that you need to put less money aside to achieve your pension goal. And you can also benefit from up to 49.5% tax relief on your investment.

Please note: investment involves risks. You could lose all or part of your investment.

All the info at a glance

Tax credit

- You can deduct money you put aside towards a pension top-up from your taxable income, but the amount you deposit may not exceed your annual margin (jaarruimte) and/or reserve space (reserveringsruimte).

- You will not be liable to pay wealth tax (for taxable income from savings and investments) on the amount you’ve accumulated in your pension account.

- You will, however, be liable to pay income tax and social security contributions on the payments you receive after retiring.

Interest and charges

Variable interest rate

The money you put aside for your pension in a pension account is intended for when you retire. The interest rate on the savings in the pension account is variable and currently stands at 1.70%. We reserve the right to change the interest rate. The interest you accrue will be transferred to your account on 1 January every year.

Costs

Opening fee

You pay a €49 opening fee when you open your pension account. At ABN AMRO, a pension account is called the Pensioenaanvulling.

Pension investment (related) fees

Pension investment is subject to a service fee charged as a fixed percentage of the value of your investments. You will be charged 25% of the annual fee on a quarterly basis. There is also a fee to cover investment funds’ expenses, i.e. a fund’s ongoing fees and transaction fees. Further details of service fee are provided on the fee sheet.

Deposits

It's up to you to decide what money you want to put into your pension account:

- the amount of your annual margin or any reserve space you have, and/or

- a bank savings product or life insurance policy with another bank or insurance company, and/or

- your business discontinuation profit or old-age reserve.

If you already have a pension account with us, you can, for example, opt to deposit an amount automatically every month. You won’t have to think about it and you’ll accrue extra pension for later without noticing.

You must just make sure that the amount you deposit into your pension account every month or year stays within your annual or reserve space. You can then deduct this amount from your taxable income on your tax return.

Withdrawals

The pension account is a special account that does, in principle, not allow any withdrawals by anyone before you retire.

If you do want to withdraw all the money in the account as a lump sum, this is called ‘commutation’. It’s important to think carefully about this, as it is subject to a commutation fee. On top of that, the Dutch Tax and Customs Administration may also impose a penalty for the commutation amount. If you’re considering withdrawing money, please get in touch.

If you decide to transfer the money in your ABN AMRO pension account to another bank or insurer before your state retirement age, you will be charged €150.

Your money is safe

The funds in your pension savings account are covered by the Dutch Deposit Guarantee Scheme, meaning that your savings are automatically protected if the bank goes bankrupt, up to a maximum of €100,000 per person. The protection applies to the total amount you have (in all your accounts together) with ABN AMRO Bank N.V.

Banks are required to abide by the asset segregation requirement. This means that your investments cannot be classed as part of your assets. You are, however, eligible for the investor compensation scheme. For more information about this scheme, search for ‘Investor compensation’ on the English pages of the website of the Dutch central bank DNB.

Terms & conditions

Take a look at our terms and conditions:

- Terms and conditions pension account (in Dutch) (PDF, 248 KB)

- Additional terms and conditions pension savings account (in Dutch) (PDF, 120 KB)

- General investment terms and conditions (PDF, 788 KB)

- Additional terms and conditions pension investment account (in Dutch) (PDF, 204 KB)

Important information:

Tax credit

- You can deduct money you put aside towards a pension top-up from your taxable income, but the amount you deposit may not exceed your annual margin (jaarruimte) and/or reserve space (reserveringsruimte).

- You will not be liable to pay wealth tax (for taxable income from savings and investments) on the amount you’ve accumulated in your pension account.

- You will, however, be liable to pay income tax and social security contributions on the payments you receive after retiring.

Interest and charges

Variable interest rate

The money you put aside for your pension in a pension account is intended for when you retire. The interest rate on the savings in the pension account is variable and currently stands at 1.70%. We reserve the right to change the interest rate. The interest you accrue will be transferred to your account on 1 January every year.

Costs

Opening fee

You pay a €49 opening fee when you open your pension account. At ABN AMRO, a pension account is called the Pensioenaanvulling.

Pension investment (related) fees

Pension investment is subject to a service fee charged as a fixed percentage of the value of your investments. You will be charged 25% of the annual fee on a quarterly basis. There is also a fee to cover investment funds’ expenses, i.e. a fund’s ongoing fees and transaction fees. Further details of service fee are provided on the fee sheet.

Deposits

It's up to you to decide what money you want to put into your pension account:

- the amount of your annual margin or any reserve space you have, and/or

- a bank savings product or life insurance policy with another bank or insurance company, and/or

- your business discontinuation profit or old-age reserve.

If you already have a pension account with us, you can, for example, opt to deposit an amount automatically every month. You won’t have to think about it and you’ll accrue extra pension for later without noticing.

You must just make sure that the amount you deposit into your pension account every month or year stays within your annual or reserve space. You can then deduct this amount from your taxable income on your tax return.

Withdrawals

The pension account is a special account that does, in principle, not allow any withdrawals by anyone before you retire.

If you do want to withdraw all the money in the account as a lump sum, this is called ‘commutation’. It’s important to think carefully about this, as it is subject to a commutation fee. On top of that, the Dutch Tax and Customs Administration may also impose a penalty for the commutation amount. If you’re considering withdrawing money, please get in touch.

If you decide to transfer the money in your ABN AMRO pension account to another bank or insurer before your state retirement age, you will be charged €150.

Your money is safe

The funds in your pension savings account are covered by the Dutch Deposit Guarantee Scheme, meaning that your savings are automatically protected if the bank goes bankrupt, up to a maximum of €100,000 per person. The protection applies to the total amount you have (in all your accounts together) with ABN AMRO Bank N.V.

Banks are required to abide by the asset segregation requirement. This means that your investments cannot be classed as part of your assets. You are, however, eligible for the investor compensation scheme. For more information about this scheme, search for ‘Investor compensation’ on the English pages of the website of the Dutch central bank DNB.

Terms & conditions

Take a look at our terms and conditions:

- Terms and conditions pension account (in Dutch) (PDF, 248 KB)

- Additional terms and conditions pension savings account (in Dutch) (PDF, 120 KB)

- General investment terms and conditions (PDF, 788 KB)

- Additional terms and conditions pension investment account (in Dutch) (PDF, 204 KB)

Important information:

“If you start early, you’ll benefit for longer from interest-on-interest or potential returns. This can make all the difference.”

Joelle - Income & Wealth adviser

The earlier you start, the longer your returns can work for you

Pension savings

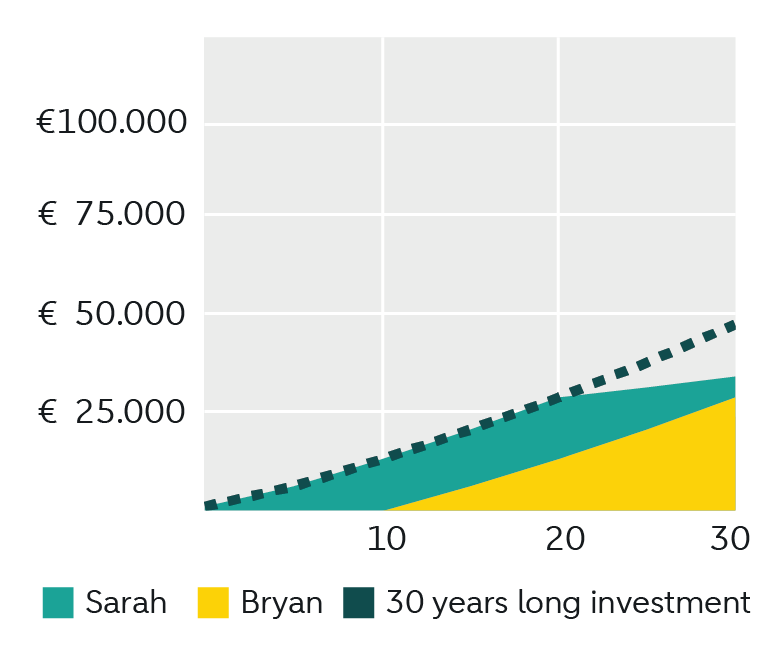

Sarah and Bryan both start saving for their pensions. They each save €100 per month for 20 years. In this example, they receive an annual interest rate of 1.70% (the current variable rate).

- Sarah saves €100 per month for 20 years. After that, she stops saving but leaves the money untouched for another 10 years. After 30 years, Sarah has approximately €34,000.

- Bryan starts saving 10 years later and also saves €100 per month for 20 years. After 30 years, Bryan has approximately €29,000.

Conclusion: In this example, Sarah has saved €5,000 more with the same contributions. This is due to the effect of compound interest.

The graph is calculated using the current variable interest rate of 1.70%. This percentage is subject to change.

Pension investment

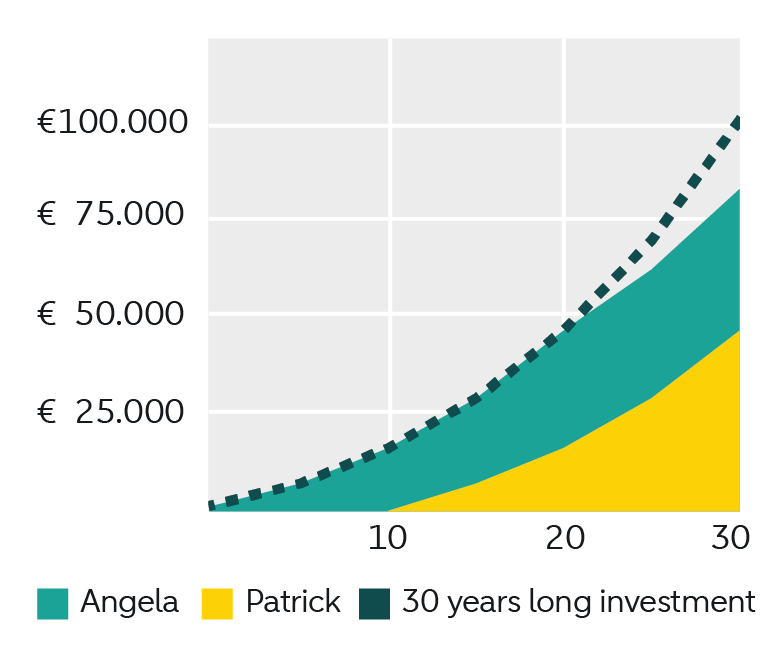

Angela and Patrick both start investing for their pensions. They contribute €100 per month for 20 years. In this example, they receive a hypothetical return of 6% per year.

- Angela invests €100 per month for 20 years. After that, she stops contributing but leaves the money invested for another 10 years. After 30 years, Angela has approximately €83,000.

- Patrick, on the other hand, waits 10 years before starting to invest and then contributes €100 per month for 20 years. After 30 years, Patrick has approximately €46,000.

Conclusion: In this example, Angela has built up €37,000 more with the same total contribution. This is due to the compound returns.

Note: This graph is an indication of the effect of returns over the long term and does not represent future results. No rights can be derived from this.

Let your pension grow automatically

If you want to top up your pension but don’t want to spend too much time and energy thinking about it, set up a periodic deposit. If you want to save and invest, simply state the split you want when you set up the periodic deposit. For example: 40% saving and 60% investment. Everything will then be processed for you automatically. Just sit back and imagine your beautiful garden or that dream trip, thanks to the extra pension you’re building up now!

Frequently asked questions about pensions

Investing involves risk

You should only invest for your pension using money you can spare and keep your investments within your annual margin. Investing involves risk. You could lose all or part of your initial investment. It is important to be aware of this.

Do you need help?

Make an appointment

Leave your details and we will call you to schedule an appointment.